dallas county texas sales tax rate

Find your Texas combined state and local tax rate. The City retains 2 and is used as follows.

Tax Information City Of Sachse Official Website

The latest sales tax rate for Dallas TX.

. The sales tax rate in Dallas is 825 percent of taxable goods or services sold within c ity limits. Always consult your local government tax offices for the latest official city county and state tax rates. The Texas state sales tax rate is currently 625.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas. The current total local sales tax rate in Dallas County TX is 6250.

What is the sales tax rate in Dallas County. This rate includes any state county city and local sales taxes. The current sales tax rate in Coppell is 825.

Dallas County is a county located in the US. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. 10555 Pagewood Dr Dallas TX 75230 is listed for sale for 749900.

2020 rates included for use while preparing your income tax deduction. The 2021-2022 tax rates are calculated by Dallas County PDF in accordance with Texas Tax Code. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. TX homes for sale dallas County. Name Local Code Local Rate Total Rate.

This is the total of state and county sales tax rates. This is the total of state and county sales tax rates. 05 is a.

The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. The 2018 United States Supreme Court decision in South Dakota v. The December 2020 total local sales tax rate was also 6250.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dallas County. 972-274-CITY 2489 Email Us. The Alabama state sales tax rate is currently.

As for zip codes there are around 138 of them. Dallas County is located in Texas and contains around 21 cities towns and other locations. The sales tax rate does not vary.

For tax rates in other cities see Texas sales taxes by city and county. City or County Rates. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Help us make this site better by reporting errors. View the Notice of 2021 Tax Rates PDF. Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes.

You can print a 825 sales tax table here. The Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three. The total sales tax rate in any given location can be broken down into state county city and special district rates.

A full list of these can be found below. The most populous location in Dallas County Texas is Dallas. Dallas County collects on average 218 of a propertys assessed fair market value as property tax.

As of the 2010 census the population was 2368139. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The average cumulative sales tax rate between all of them is 825.

Texas has a lot of different counties 254 in total which is the largest number of counties within a state in the US. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. The combined sales tax rate for Dallas County TX is 725.

Tax rate and budget information as required by Tax Code 2618 PDF. There is no applicable county tax. The tax is collected by the retailer at the point of sale and forwarded to the Texas Comptroller on a monthly or quarterly basis.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. 27129 Estimated MortgageTax minimize. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas.

Tax Office Past Tax Rates. The Dallas County sales tax rate is. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

214 653-7811 Fax. 1 for City operations. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825.

104 rows It is the second-most populous county in Texas and the ninth-most populous in the. The Texas sales tax rate for most counties is 2 which means that most counties when combined. The minimum combined 2022 sales tax rate for Dallas County Alabama is.

It is a 019 Acres Lot 2544 SQFT 3 Beds 2 Full Baths 1 Half Baths in Cr. Dallas TX 75202 Telephone. Dallas County Coronavirus COVID-19 Information.

City or County Rates. The table combines the base Texas sales tax rate of 625 and the local county rates to give you a total tax rate for each county. The base state sales tax rate in Texas is 625.

The City of DeSoto Texas 211 East Pleasant Run Road DeSoto TX 75115 Phone. The world-famous city of Dallas is situated within multiple. 214 653-7888 Se Habla Español.

Texas Sales Tax Guide For Businesses

How To File And Pay Sales Tax In Texas Taxvalet

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

How To Charge Your Customers The Correct Sales Tax Rates

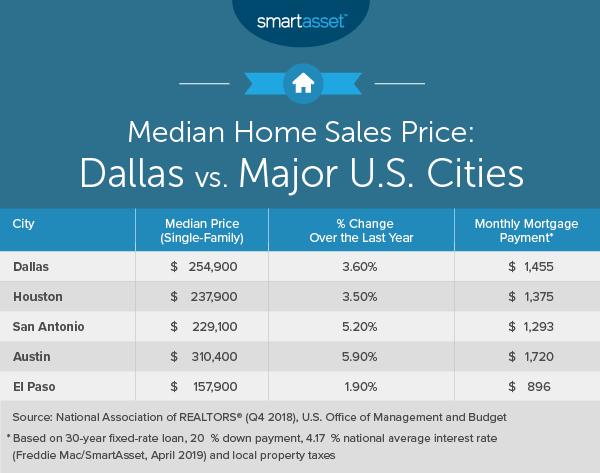

Cost Of Living In Dallas Smartasset

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Tax Rates Richardson Economic Development Partnership

How To Charge Your Customers The Correct Sales Tax Rates

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

How To Charge Your Customers The Correct Sales Tax Rates

2021 2022 Tax Information Euless Tx

Texas Sales Tax Rates By City County 2022

Texas Sales Tax Small Business Guide Truic

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key